June 22, 2018 | Tommy Marzella

June 22, 2018 | Tommy Marzella

.png?width=873&name=Why-how-to-help-your-employees-achieve-financial-wellness%20(1).png) Over half of U.S. employees report that they’re financially stressed and 70% of those people say they would be unable to cover unexpected expenses. What's more, 90 million are living paycheck-to-paycheck with less than $400 in liquid savings. There's no other way to say it; a considerable number of your workers are struggling financially.

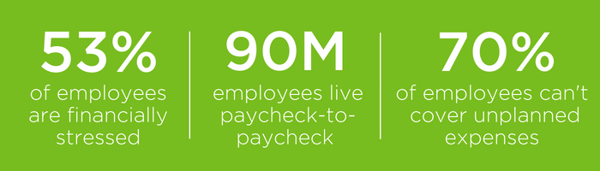

Over half of U.S. employees report that they’re financially stressed and 70% of those people say they would be unable to cover unexpected expenses. What's more, 90 million are living paycheck-to-paycheck with less than $400 in liquid savings. There's no other way to say it; a considerable number of your workers are struggling financially.

And their financial worries are costly to more than just themselves. According to a PWC survey, they can negatively affect personal and professional relationships, health, and productivity and performance at work.

The study uncovered that 30% of employees are distracted by their finances at work and 46% of the distracted employees say they spend three hours or more at work each week dealing with issues related to their personal finances. This loss of productivity from those distractions costs companies $3.3 million per year for an employer with 10,000 workers.

Financial wellness programs are your opportunity to re-engage and retain current staff, attract candidates and ensure your business remains viable. In fact, according to the same survey, 54% of people want help with their finances and 25% say financial wellness benefits are the most desired employer benefit they don’t already have. Convinced that employee financial programs are a key to success? We are too. Here are four ideas to help get you started on your plan.

Understanding where your money is coming from and where it is going is one of the most important steps for financial wellness. Teach your employees to follow the tried and true 50-20-30 budget; a minimalist approach to budgeting because it separates monthly expenses into three categories:

One of the perks of a 50-20-30 budget is its flexibility, particularly for individuals who’ve previously never created a budget. While it’s recommended 30 percent of monthly income is set aside for discretionary spending, that percentage can actually be lowered if an individual would prefer to save more for future needs or emergencies.

.png?width=600&name=Employee%20Financial%20Stress%20Is%20Costly%20(1).png)

Carrying a large of amount of debt can severely limit an employee’s financial flexibility. No one wants to have debt, but the truth is, nearly 80 percent of Americans have some form of debt, which includes credit cards, mortgages and student loans.

Some debt is worse than others – particularly credit card debt that can cause people to rack up crippling fees and interest over time. PWC reports that nearly 60% of people consistently carry credit card balances month to month.

Employees should consider working a debt pay-off plan into their 50-20-30 budget and there are several free apps out there on the market that can help them track their spending and saving habits.

One of the biggest pain points and sources of debt for any employee is emergency situations and the need for access to money — fast. Unfortunately, an employee in this situation may not be scheduled to receive a paycheck until the following week.

Not all hope is lost. Technology exists today that gives employees access to earned but unpaid wages at zero risk to the organization. For example, the OnShift Wallet lets workers access up to 50 percent of their current earnings in the event they need to manage an unexpected expense.

This helps employees avoid costly alternatives like high-interest payday loans and credit card debt.

“Sometimes I need a little extra help between paychecks. With OnShift Wallet, I’m able to access the money I’ve earned before payday. Instead of relying on credit cards or payday loans, I know that I can rely on OnShift Wallet to help me when my budget gets tight.”

- Employee, Assisted Living Provider

In addition to offering financial wellness apps, employers may also want to offer financial education opportunities for workers.

These classes can focus on key pain points employees experience, for instance, ways to better manage finances to break free of living paycheck to paycheck. Other education ideas may be:

Consider asking your employees if there are any topics that they would like to see covered. Simply showing interest in their financial well-being shows that you care and does wonders for employee satisfaction and engagement.

By developing a budget, making an effort to pay off debt and utilizing financial tools, senior care employees will be able to gain financial confidence, reduce stress and improve performance at work.

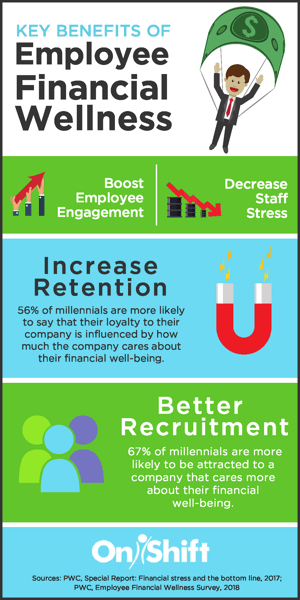

Want even more proof that your organization should take employee financial wellness programs more seriously? According to PWC, 56% of millennials are more likely to say that their loyalty to their company is influenced by how much the company cares about their financial well-being and 67% say they’re more likely to be attracted to a company that cares more about their financial well-being.

Sources:

https://www.pwc.com/us/en/private-company-services/publications/assets/pwc-2018-employee-wellness-survey.pdf

https://www.pwc.com/us/en/private-company-services/publications/assets/pwc-financial-stress-and-bottom-line.pdf

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/financial-wellness-trend.aspx

https://www.creditkarma.com/studies/i/average-debt-american-household-on-rise/

https://blog.mint.com/saving/the-minimalist-guide-to-budgeting-in-your-20s-072016/

https://www.payactiv.com/assets/pdf/infographic-payactiv-cost-of-waiting-for-pay.pdf

Subscribe to the OnShift Blog

Recent Posts

Categories

About Tommy Marzella

Tommy Marzella is a Portfolio Marketing Manager for OnShift.

See for yourself why thousands of providers rely on OnShift’s innovative software for recruitment, hiring, workforce management, pay and engagement. Request your personalized demo today.